Never Miss a Tax

Strategy.

Explain It With

Confidence.

Get Paid for Your

Competence.

Tax Maverick Pro is an AI-driven tax strategy system built for tax professionals who want clarity, confidence, and consistency in advisory.

It helps you identify opportunities others miss, organize execution, and deliver tax savings in a way clients understand and trust.

12 Months of Tax Maverick Pro

Instead of relying on memory, notes, or disconnected tools, you work from one system that keeps everything visible and moving forward.

You know what to recommend.

You know where each client stands.

You know nothing is being overlooked.

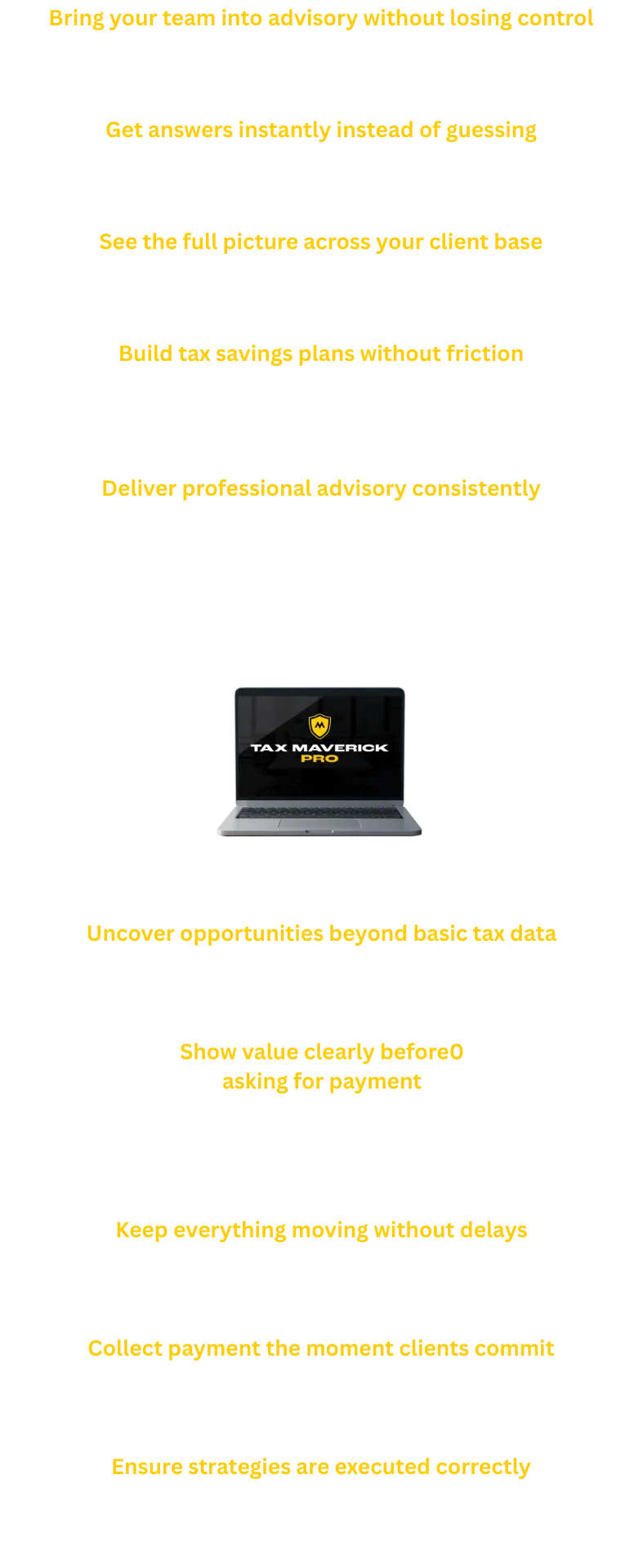

What You Gain With Tax Maverick Pro

PLUS:

Weekly Live Tax Strategy Workshops

Instead of relying on memory, notes, or disconnected tools, you work from one system that keeps everything visible and moving forward.

Bring real client situations.

Ask individualized questions.

Get guidance before you present.

This is where confidence is reinforced through real-world application.

PLUS:

Private Community of Tax Professionals

Join an exclusive community of 1,000+ accountants from across the country.

Members:

Share real insights and best practices

Discuss live client scenarios

Learn what's working right now

Support each other's growth and success

You're not operating in isolation.

You're surrounded by tax professionals raising the standard.

Your 12-Month Tax Maverick Pro Includes This Bonus

Maverick Tax Strategist™

Certification Program

($10,000 Value)

This certification is not normally included.

It's provided here to accelerate confidence and remove hesitation when stepping into advisory.

Using Tax Maverick helps you spot strategies.

Earning competence is what allows you to explain and defend them clearly.

You gain certainty around:

When strategies apply

How they are implemented

Where they flow on the return

Which forms are required

How IRS code supports them

You're prepared before the client ever challenges a recommendation.

This is not a sit-and-get certification. It is:

STRUCTURED

TESTED

GRADED

You'll also receive up to 12 hours of CE throughout the year.

This is where competence turns into confidence. Watch how it's earned.

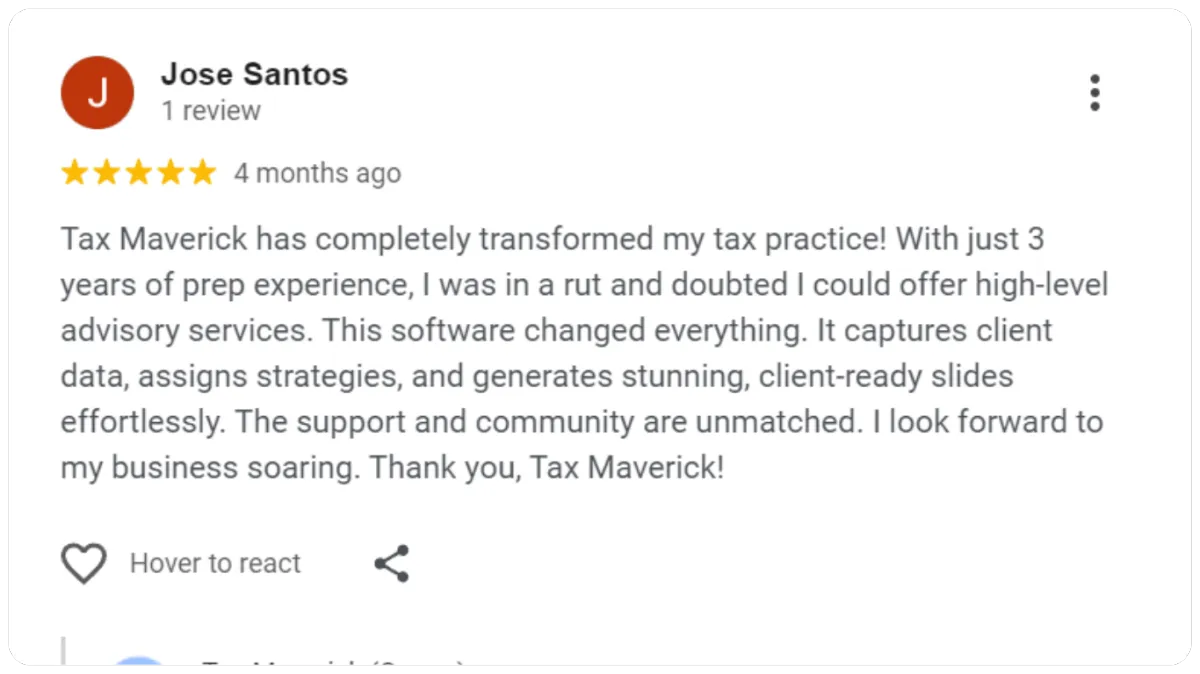

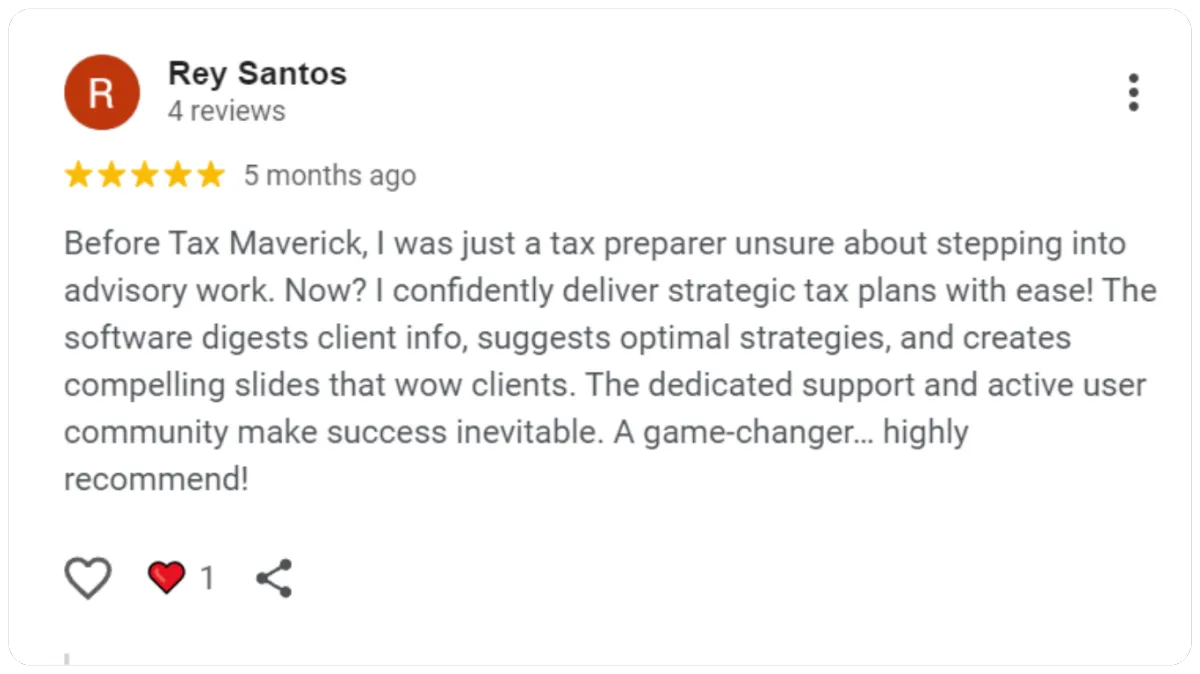

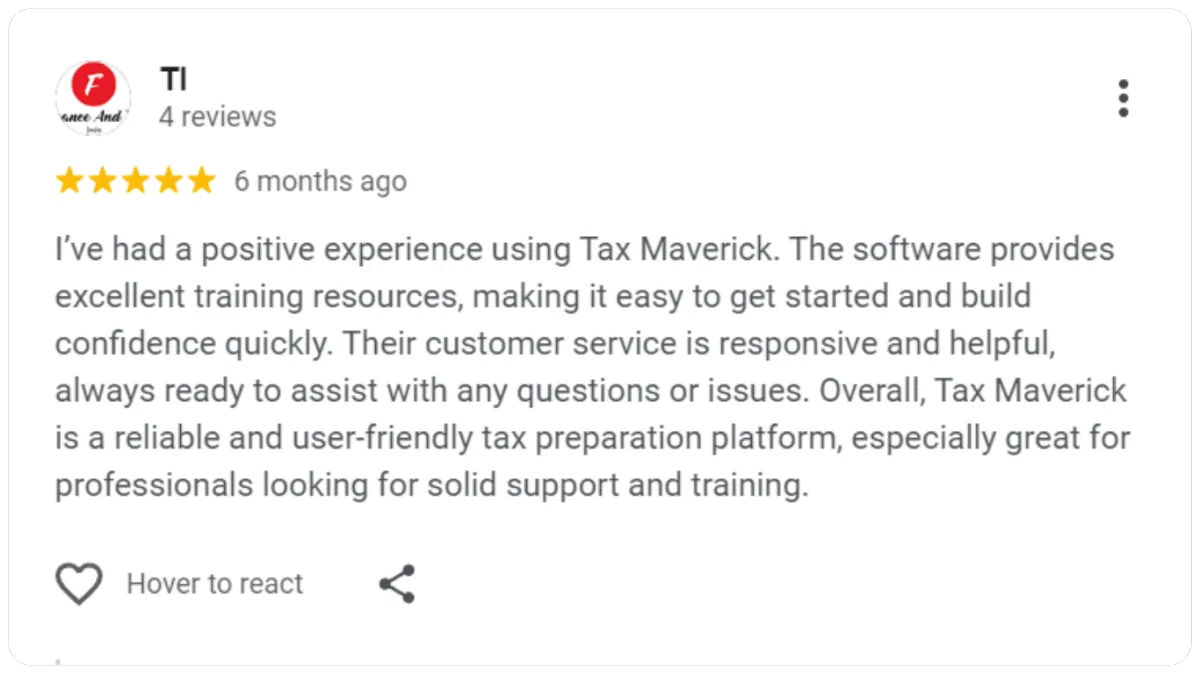

What Certified Mavericks Say After Completing the Certification

Here's Everything You Get

What You Receive

12 months of Tax Maverick Pro ($7,164 value)

Full access to the advisory operating system that keeps every client, strategy, and execution step organized and visible.

Up to three users

Bring your team into advisory while maintaining consistency and control across every client.

Weekly live tax strategy workshops

Ongoing support to ask real questions, review real cases, and reinforce confidence before client presentations.

Private professional community access

Connect with serious tax professionals who are actively raising the standard of advisory.

Bonus: Certified Maverick Tax Strategist™ Program ($10,000 value)

A structured, earned certification that validates your competence and strengthens your authority in advisory conversations.

Private professional community access

Your Investment Today: $6,997

Save $10,167

Tax Maverick Pro + Certified Maverick Tax Strategist™ Program $6,997

FAQs

Is it a tax preparation software?

No, it’s not a tax preparation software. It’s a tax strategy software, designed to help you proactively reduce your tax liability through personalized strategies

How does Tax Maverick protect my privacy and secure my data?

At Tax Maverick, your privacy is our top priority. We use secure, cloud-based technology with double encryption to protect all client data. In addition, we maintain backup servers to ensure your information is always safe, protected, and accessible only to you.

Is this too expensive for me right now?

Think of it as an investment in your future. The workshop, software, and resources you’ll receive will enable you to start charging clients $2,000 to $5,000 per tax plan. That means you can easily make back your investment after just one or two clients. Plus, we offer a payment plan to make it easier for you to get started without a big upfront cost.

Will I be able to create tax plans for any type of client?

Yes! The strategies and tools we teach in the Maverick Weekly Workshop work for clients of all kinds—whether you’re working with individuals, business owners, or real estate investors. Our system is flexible, allowing you to tailor your approach to different client needs.

And with our Tax Planning Software, you’ll be able to customize tax plans based on each client’s specific situation.

What if I don’t see the results I expect?

We’re so confident in the value of this workshop that we offer a 10x guarantee. If you attend and don’t feel like you’ve received 10 times the value of what you paid, we’ll refund your money—no questions asked. You have nothing to lose and everything to gain.

What if I’m not confident enough to offer tax advisory services?

We’ll provide you with all the tools and support you need to build your confidence. With the help of our Tax Planning Software and step-by-step training, you’ll feel empowered to offer these services with ease. Plus, you’ll get hands-on experience during the workshop, which will boost your confidence in delivering high-value advisory services.

What makes this certification valuable?

The Certified Maverick Tax Strategist designation is a performance-based credential that validates your ability to build, communicate, and deliver strategic tax planning at a high level.

It is valuable because:

• It focuses on execution, not just education

• It includes twelve IRS-approved Continuing Education hours

• It is a trademarked credential, not a generic course

• It provides a professional plaque, badge, and certification for public display

• It grants access to the Certified Advisor Network, launching in 2026

This certification shows clients and peers that you are operating at the top tier of strategy and leadership in the tax industry.

Is this certification recognized by the IRS?

The IRS does not recognize or endorse private certifications.

However, the certification includes twelve hours of IRS-approved Continuing Education through an authorized CE provider. These credits are accepted for:

• Enrolled Agents

• CPAs (depending on state board rules)

• Attorneys where applicable

• Tax professionals required to meet annual CE obligations

What is required to become certified?

• Complete all four training modules

• Pass a certification quiz with a score of 75 percent or higher

• Submit a strategic tax plan

• Record and submit a five-minute walkthrough video

• Complete all requirements within twelve months of enrollment

Can I use this certification publicly?

Yes. Once certified, you can display the title Certified Maverick Tax Strategist:

• On LinkedIn

• In your proposal decks

• In your email signature and client onboarding

• Inside the Certified Advisor Network directory

• In all client-facing and team-facing brand materials

Do I need any prior certifications or tax experience before enrolling?

No, this certification is for all levels of expertise.

© 2025 Tax Maverick. All rights reserved.